Overview Funding Program, also known as OFP or OFP Funding, is an innovative, instant funding trading firm, founded with the aim of providing traders with immediate access to capital, without the long-standing trader deterrents such as evaluation challenges and profit targets.

OFP Funding Overview

Established in 2022, OFP Funding is headquartered in London, UK. As a relative newcomer to the proprietary trading space, the company aims to distinguish itself by providing traders with a highly transparent and flexible trading environment.

OFP Funding represents a true alternative to the established industry norms, challenging the long-standing practices with the introduction of true instant funding.

The company’s philosophy is based around the idea that trading should be made easier and more accessible, which is why its offer differs so widely from what we’ve seen from other similar trading firms in the past years.

Instant Funding Account & Pricing

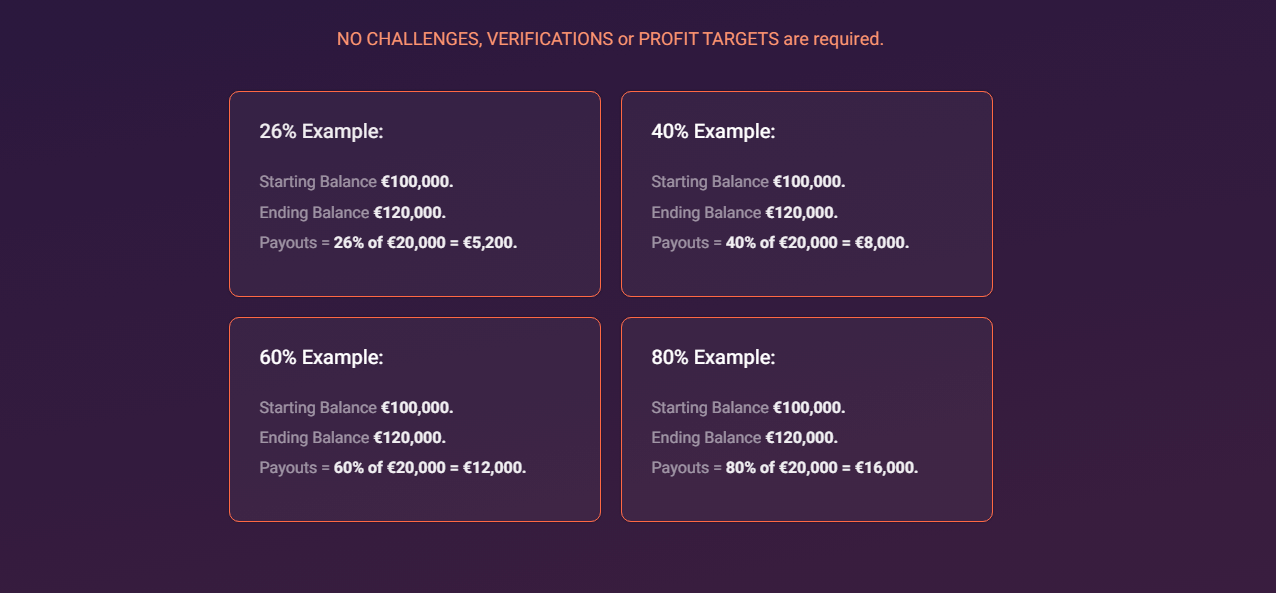

As we mentioned above, the main distinguishing factor between OFP Funding and other prop trading firms is its approach to funding. There are no usual evaluation challenges or profit targets here, as you instantly get access to a funded account.

The offer itself is extremely customizable, allowing you to choose your account size, the profit split percentage and the maximum daily drawdown rule you want to follow. You can also choose how you want to handle payout times, as well as the currency you want to use.

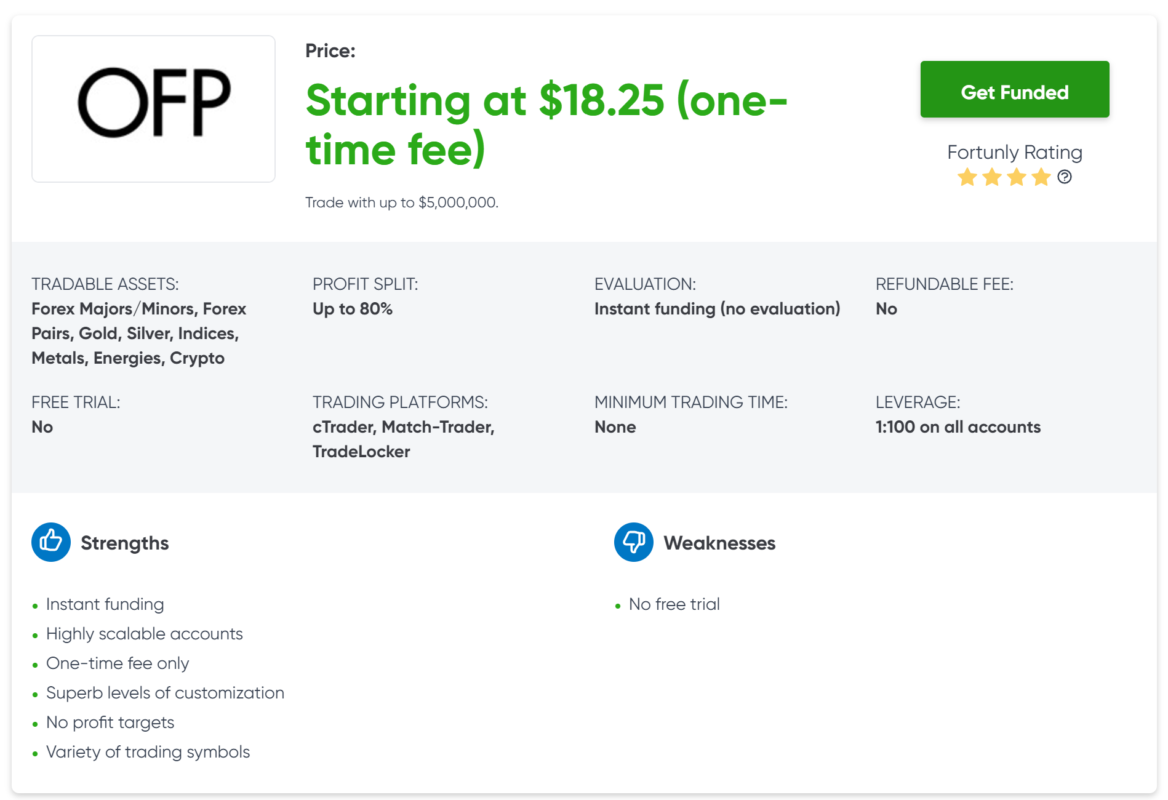

OFP only has a one-time fee that you have to pay, which is another distinguishing feature in a market dominated by monthly subscription fees. The lowest fee here is just $18.25, while the highest currently stands at $2,997.

The fees are not refundable though, and there are no free trial or demo options on the site, which is something we’d like to see.

Still, as the barrier of entry is probably the lowest on the market, it’s not exactly as big of a deal as it is with some of the other, more expensive firms we’ve reviewed so far.

There are also no minimum withdrawal requirements here, and you can withdraw profits from day four, as long as you’ve opted for the “on demand” payout option. Otherwise, you can withdraw profits either bi-weekly or monthly.

The Scaling Plan

OFP Funding also offers a great scaling plan, which rewards consistently profitable traders by gradually increasing their account sizes over time.

To qualify, you must achieve a 20% profit on your account within a three-month period, without breaking any of the trading rules, which we will explain a bit further below.

If you succeed, OFP will increase your account by 25% of the initial balance, which can be repeated until you reach a maximum of $5,000,000.

On the other hand, if you do not meet the requirements within that three-month timeframe, you will not be penalized and will be able to qualify for scaling in subsequent cycles.

Trading Rules & Objectives

OFP Funding has implemented a set of trading rules that you must follow in order to prove that you are a disciplined trader that can effectively manage risk.

Basically, you have to respect maximum daily loss limits, maximum overall loss (trailing drawdown) and the consistency rule called Inconsistency Score. Exceeding any of the limits and breaking the rules will result in harsh consequences on your account.

The Maximum Daily Loss rule caps the allowable loss on any given trading day. This rule applies to both equity and balance. The day resets at 12:00 AM CET (Central European Time).

Your account equity or balance must not fall below the highest balance of the day minus the selected daily loss limit. For example, if you select the 5% daily loss limit on a $5,000 account, the maximum daily loss limit must not exceed $250.

If the limit is breached, your account will be immediately terminated with no option for recovery.

The Maximum Overall Loss ensures that the total account equity or balance does not drop below a defined percentage of the initial account balance. This limit is dynamic and calculated from the account’s highest achieved balance.

Your account equity must remain above the trailing drawdown threshold, calculated as the difference between the highest balance achieved and the maximum loss allowed. For example, if you select a 10% overall loss limit on a $25,000 account, the overall loss limit must not exceed $2,500.

Exceeding the Maximum Overall Loss limit also results in account closure with no possibility of reinstatement.

The Inconsistency Score Rule promotes trading consistency by limiting disproportionate performance on individual trading days compared to the overall account profit.

As a trader, you must stay below your account’s defined consistency threshold to qualify for payouts. The score here can be calculated as your best day’s total profit divided by the PnL (Profit and Loss) of your reference period.

If your inconsistency score is higher than allowed, your account won’t be closed but payouts will be postponed until your performance improves and shows consistent results. OFP also allows you to reset the Inconsistency Score upon payment.

To maintain fairness and reduce exploitative behavior, OFP Funding prohibits certain trading methods. Violating these restrictions may result in account suspension or closure.

Banned strategies include:

- Martingale

- Grid Trading

- Latency Arbitrage

- News Straddling

- Tick Scalping

How OFP Funding Compares to Other Proprietary Trading Firms

Trading Instruments & Platforms

OFP Funding is primarily focused on forex trading, which is why its selection of forex pairs you can trade on is the largest offered here, with 61 pairs currently available, covering everything from major, minor and excotic pairs.

You can also trade on indices, which include US500, UK100 and JP225, along with a few dozen more options. The firm has a nice selection of commodities as well, from precious metals like gold and silver to energy products like Brent crude oil and raw materials like cocoa and coffee.

Lastly, there is a selection of bonds you can trade on, which covers all the major US Treasury Notes, as well as European government bonds.

In terms of trading platforms, OFP Funding currently provides three different choices for its traders, namely the cTrader, Match-Trader and TradeLocker platforms.

These are all well-known and recognized platforms on today’s market, and are available on desktop, web and mobile, offering real-time data, advanced charts and analytics and secure trading environments.

Educational Resources

OFP has a robust selection of articles, podcasts and quizzes on its site, allowing you to learn, improve and test your skills all in the one place.

It also has a mental health coaching program, which is something that we’ll always applaud, as trading is a high-stress environment that requires discipline and emotional strength for long-term success, so a program like this one can be beneficial for a lot of people.

Customer Satisfaction and Support

The company has garnered a lot of positive feedback from traders around the world, and currently holds a 4/5 star rating on Trustpilot, from a few thousand reviews.

Customers are most often praising the quality of the customer support, which is available via email, as well as through the Live Chat option on the website, and on Discord. There are a few channels there where traders share their weekly payouts, so you can check how others are doing, and look for any tips.

There are also a lot of positive customer comments regarding the high levels of customization and flexibility that OFP offers.

In Conclusion

All in all, OFP Funding is a solid choice for traders of all skill levels, especially those that can properly understand their strengths and customize their account in order to get the most out of it. With instant funding, high scalability and a great selection of available tools and educational resources, it stands out in an already saturated market.

Comments (No)