Overview

Thanks to an incredibly active trading community, great profit splits, simple rules, and obtainable profit targets, the Funded Trader has quickly become a very popular prop firm. Frequent discounts, like the current 15% off + 150% refund with code TFTOCTOBER4, combined with their already great price points make them one of the best prop-trading bargains.

Pros

- Great trading community: The Funded Trader has a Discord channel with more than 50,000 active members—great for getting trade ideas, learning new trading techniques, figuring out the rules, and generally supporting one another.

- Great prices: Even before you factor in the Funded Trader’s frequent discounts, they are typically 20% or more cheaper than FTMO.

- Generous drawdowns: The Funded Trader’s max daily drawdown (6%) and overall max drawdown (12%) on their standard account are among the most trader-friendly in the industry.

- Lax trading rules: The Funded Trader doesn’t outlaw any trading strategies beyond those that take advantage of the demo mode environment.

- Industry-best profit splits: Default is 80% profit split, which scales up to 90%, but frequent promotions allow traders to start at 90%.

- Few minimum trading days: A standard account has just three minimum trading days, or you can opt for a Rapid account, with no minimum trading days at all.

- Fully refundable fees: Pass the two-stage evaluation and you’ll get your sign-up fee back.

- New one-step evaluation: The new Knight Challenge offers a one-step evaluation with no minimum trading days.

Cons

- Funded accounts stay in demo mode: Your percentage of the profits will be very real, but you’ll never be in the real market. This business model caught the eye of the CFTC with My Forex Funds, and might put the Funded Trader in regulators’ cross hairs.

- Slippage: Some traders have reported an increase in spreads and slippage recently; the Funded Trader has addressed the issue with their platform providers and things seem to be improving.

- Overwhelmed customer service: The Funded Trader has grown so fast they occasionally fall behind with addressing trader issues.

The Funded Trader current promos

- 50% off all $5K – $10K accounts + 125% refund with code VICTORY50

- 15% off all accounts + 150% refund with code TFTOCTOBER4

The Funded Trader Program highlights

- 80%–90% profit split

- No minimum trading days with Rapid account, only three with a Standard account

- Leverage up to 200:1

- 6% max daily drawdown, 12% overall daily drawdown

- Scaling up to $1.5 million

- Unlimited trading days

- 8% profit targets for phase 1 of Royal and Rapid accounts, 5% for phase 2

- 10% profit target for phase 1 of Standard Challenge

- Payouts every two weeks for those with Rapid accounts

- Trade forex (44 pairs), gold, silver, and indices (9)

- New Knight Challenge: One-step evaluation, 3% max daily drawdown, 6% overall max drawdown, 10% profit target

Who should sign up with the Funded Trader?

If you’re a trader who likes to participate in or benefit from a very active trading community, the Funded Trader is probably your best choice. The Funded Trader’s Discord has a channel devoted to just about everything, with tons of helpful tips, trade ideas, contests, account troubleshooting, competitive chess tournaments, and more.

Bargain hunters should also be knocking at the Funded Trader’s door. Not only are their baseline prices some of the best in the business, but the Funded Trader also posts frequent promotions that make them a truly great value.

Traders who are in a hurry to get their capital but don’t want to give up 50% of their profits like they would at a prop firm like the 5%ers, which provides instant funding, can open a Rapid account with the Funded Trader. The Rapid account features zero minimum trading days. Hit your profit targets (8%) and you’ll be funded in a flash.

If your trading style has been banned by other prop firms, you may find a home at the Funded Trader. The Funded Trader places very few restrictions on trading styles, allows weekend and overnight holdings with most accounts, and even allows trade copiers under certain conditions.

Who should NOT sign up with the Funded Trader?

I still consider the Funded Trader to be one of the new kids on the block. They’ve been around a few years now, but they are so aggressive with their promotions and trader acquisition that they still feel young. They have a proven track record of making payouts, and their founders are veteran forex traders, but if you are the type that craves stability, there are other prop firms that have been around longer.

Traders who need to be a direct part of the real market rather than remaining in a demo environment should also look elsewhere. Like a lot of prop firms, the Funded Trader keeps its traders in demo mode even after they’ve been funded. They pay out real profits, of course, but you’ll never be an actual participant in the market. My Forex Funds used a similar business model, and caught the eye of the CFTC. Hoping the Funded Trader doesn’t come under the same scrutiny.

If you want to trade crypto or shares, you’ll have to find another prop-trading firm. The Funded Trader is mainly focused on forex, and they eliminated crypto trading in May of 2022. You can still trade 42 currency pairs, nine indices, plus gold and silver.

All things considered . . .

If you value community, obtainable profit targets, lax rules, high profit splits, and you don’t mind trading mostly forex in demo mode, the Funded Trader is an affordable option, especially with their current promotion.

The Funded Trader basics

The Funded Trader origin story

The Funded Trader was founded by Blake Olson, Angelo Ciaramello, and Nick D’Arcangelo, the experienced traders behind VVS Academy and Forex League. They used their extensive experience plus ample feedback from their trading networks to put together a proprietary trading firm that was designed for traders, by traders. The result was the Funded Trader, which officially got off the ground in 2020.

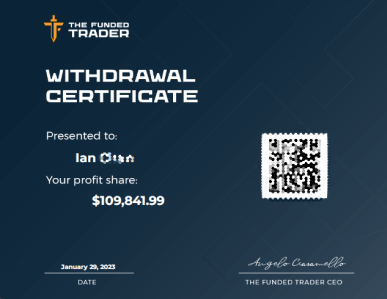

The Funded Trader proof of payout

The Funded Trader publishes new proofs of payout on their Discord, Instagram, YouTube, and other social media channels regularly. Here are some examples:

How does the Funded Trader work?

The Funded Trader works like most prop trading firms. You pay for an evaluation process that is designed to find consistently profitable forex traders. If you pass the evaluation by hitting profit targets and staying within the trading parameters, the Funded Trader will give you capital equal to the account size you signed up for.

You can trade this capital and keep 80%–90% of any profits you make. The Funded Trader will cover any losses you incur, but if you lose too much they will suspend your account and you’ll have to go back through the evaluation process.

How much does the Funded Trader cost?

The Funded Trader only charges one-time sign-up fees, and they are 100% refundable should you pass your evaluation and receive a funded account.

Standard Challenge

| Account size | Refundable one-time fee |

| $25,000 | $189 |

| $50,000 | $315 |

| $100,000 | $549 |

| $200,000 | $949 |

| $400,000 | $1,898 |

Rapid Challenge

| Account size | Refundable one-time fee |

| $50,000 | $299 |

| $100,000 | $499 |

| $200,000 | $899 |

Royal Challenge

| Account size | Refundable one-time fee |

| $50,000 | $289 |

| $100,000 | $489 |

| $200,000 | $939 |

| $300,000 | $1,399 |

Knights Challenge

| Account size | Refundable one-time fee |

| $25,000 | $189 |

| $50,000 | $289 |

| $100,000 | $489 |

| $200,000 | $939 |

My Funded Trader evaluation

The Funded Trader fared very well in my rankings thanks to their outstanding profit splits, affordability and education resources. A 9.1 overall ranking is good enough to place them amongst my best prop trading firms for 2023.

Their overall score is based on how I ranked the Funded Trader according to the following seven factors:

Profit splits: 10/10

Like a lot of prop firms, the Funded Trader got caught up in the race to the top, in which prop firms began competing for who gave out the highest profit split. Firms like Topstep, FTMO, and the Funded Trader emerged victorious with 80%–90% splits, but the real winners, of course, were the traders.

All Funded Trader accounts start out at an 80% profit split, which is generous enough, but once you’ve passed the evaluation phase you can become eligible to scale up to 90% as a funded trader. It works like this: Funded traders who average a 6% return over their first three months or achieve a 2% return in each of their first three months begin the scaling process and are eligible for the 90% split.

You can also get the 90% profit split through promotions. The Funded Trader will frequently offer both a discount and a 10% bump to 90% profit splits with certain promo codes.

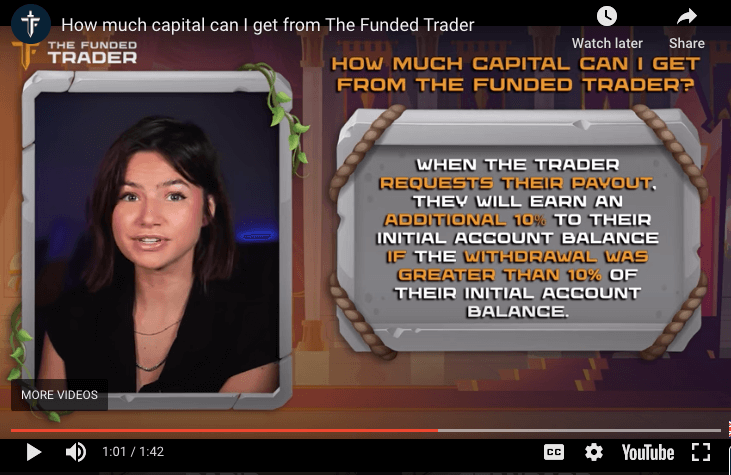

Scaling opportunities: 7/10

The Funded Trader’s scaling plan is good, but not quite as transparent as what you get at other prop firms. A lot of prop firms very clearly spell out a simple set of requirements, but the Funded Trader makes it a little more complicated than it needs to be in my opinion.

Once you’re funded with a Standard account, you need to post an average return of 6% or a profit of 2% or more in each of the three months. At that point you can receive 25% of your initial balance as additional capital. That’s a pretty nice capital increase, especially if you’re trading a $200K account. You can continue to do that every three months, until your account has reached the maximum of $1.5 million capital.

That is pretty straightforward, but there are other rules, such as you can only request scaling while you are awaiting a withdrawal, because your account must be equal to its initial balance before you scale. So if your $200K account is up to $212,000, you have to withdraw the $12K in order to get scaled up to $250K.

For rapid accounts, it also seems a little unnecessarily complicated. To start, you have to make more than 10% profit over your initial balance in one profit split, then you have to request that 10%+ as a payout, in order to get a 10% balance increase. So with a $100K account, if you make $11,000 profit, you have to withdraw the $11,000 in order to get $10,000 more in capital.

So basically, you’re replacing your capital with the firm’s capital, which is great, but you’re not scaling up by leaps and bounds, as you’ll still be around $110K in capital.

All that is just to become eligible for the first scaling opportunity. To scale beyond that, traders have to make a 10% profit in three months and make two withdrawals during that three-month period.

As I mentioned above, traders who are eligible for the scaling program also become eligible for the 90% profit split.

I’ve reviewed a lot of prop firms, and I’m pretty sure that’s more ink than I’ve ever had to use to explain a scaling program. Honestly, it’s not quite as complicated as it seems, but the best scaling programs are also the simplest in my opinion.

Trade parameters/profit targets: 10/10

The Funded Trader is pretty trader-friendly when it comes to max drawdowns and profit targets. The 8% profit target offered in the Rapid and Royal accounts is below that of most other prop firms, and that drops to just 5% for phase 2 of your challenge.

For the Standard account, the 6% daily and 12% overall drawdowns are about as generous as you’ll find amongst reputable prop-trading companies.

The rest of the Funded Traders rules are also pretty simple. Traders have 35 days to pass phase 1 and 60 days to pass phase 2. Weekend holding and trading around important news releases is allowed for any swing accounts or for Royal Challenges, and there are no lot size limits for any of the challenges.

Affordability/value: 10/10

The Funded Trader probably deserves a 10+ when it comes to value. Their prices are consistently among the lowest in the prop-trading world, but tapping into their educational resources and their trading community can be invaluable. Even if you don’t make it to a funded account, the experience can be well worth the small sign-up fees.

Educational resources: 10/10

As I’ve already mentioned, the Funded Trader’s amazing community does a lot of the work for them in terms of helping traders learn the market. Beyond that, the Funded Trader also offers free monthly competitions that are another great learning opportunity. Every month there’s a new contest, and winners receive free accounts or significant discounts. Competition is fierce, however, with more than 20,000 participants on average.

The Funded Trader also frequently updates their social media channels. Their YouTube channel, in particular, features 3–4 new videos per week. Some of them are obviously promotional, but you’ll also find a lot of good educational content that focuses on different trading strategies.

Tradable assets: 8/10

The Funded Trader was founded by forex guys, so obviously forex is their chief focus. To that end, they offer trading in 40+ currency pairs. They do seem to be expanding their tradable assets a bit.

They added nine indices this past year, and gold and silver are also available for trade. If you’re a forex trader, you’ll be happy. If you want to trade shares or crypto, like you can at other firms, you should look elsewhere.

Trustworthiness: 9/10

I hold new prop firms to a pretty tough standard because anyone who has been around the prop-trading business for a while has seen how easy it is for a prop firm—even a reputable one—to go under. That said, the Funded Trader has an enormous community of satisfied traders and an excellent rating on TrustPilot. There’s overwhelming evidence that they make their profit payouts. They’re legit, and they’re here to stay.

My overall rating: 9.1/10

For forex traders, the Funded Trader is about as trader-friendly a prop firm as you are going to find. They’ve earned traders’ trust and offer top-tier profit splits, obtainable targets, and straightforward rules. They’re also a great bargain. To join the best trading community in the business at a 10% discount, sign up here.

What others are saying

TrustPilot

The Funded Trader has an excellent (4.6/5) rating on TrustPilot with well over 4,000 reviews. Overall, that’s obviously a big vote of confidence, but they’ve received some recent one-star reviews from those frustrated with the KYC (Know Your Client) protocols, and others who are frustrated with some recent server issues that the Funded Trader is in the process of resolving.

These few negative reviews are completely drowned out by the 89% of traders that gave the Funded Trader a full five out of five stars. These happy traders cited good customer service, simple trading platforms, and overall trustworthiness as reasons for their satisfaction.

The Funded Trader also fares well on Facebook, earning a 4.9/5 with 91 reviews. These reviews need to be taken with a grain of salt, however, as a number of the five-star reviews are actually people trying to promote other services. The reviews that are legitimate speak again to the Funded Trader’s customer service as well as their transparency.

Overall

Recent server issues aside, the Funded Trader is well liked in the prop-trading community. They have quickly assembled a legion of loyal traders who are publicly lauding their favorite prop-trading company.

Frequently Asked Questions

Is the Funded Trader legit?

Yes. Their enormous trading community is proof enough that the Funded Trader is a legitimate prop-trading firm that funds consistent traders, makes payouts on time, and looks out for their traders’ best interests.

Some less-than-reputable firms have cast a shadow of doubt across the whole industry, but the Funded Trader has quickly become one of the most respected names in prop trading.

Does the Funded Trader offer discounts, coupons, or promo codes?

Yes, the Funded Trader offers frequent discounts. Here’s a link to their most recent promo for 50% off all $10K challenges with the code KINGDOM50.

Can anyone join the Funded Trader?

The Funded Trader is open to anyone other than those residing in the following countries: Cuba, Iran, Lebanon, Syria, North Korea, Libya, Sudan, and Somalia. The Funded Trader blames restrictions connected to its payment-exchange accounts for the omissions.

Can Americans join the Funded Trader?

The Funded Trader is based in the US, so yes, Americans can join.

What is the Funded Trader Challenge?

The Funded Trader has four challenges: the Standard Challenge, Royal Challenge, Rapid Challenge, and Knights Challenge. Each challenge has different rules, but the fundamentals are the same. Pass an evaluation on a demo account with virtual funds—two phases for the Royal and Rapid Challenge, but one phase for the Knight Challenge—and you’ll receive a funded trading account.

A funded trader still has to abide by the rules but will receive 80%–90% of the profits they make with their funded account and won’t be responsible for any of the losses.

How do you pass the Funded Trader Challenge?

In a nutshell, to pass any of the Funded Trader Challenges, you have to meet your profit targets without going over your maximum drawdown limits.

The Funded Trader offers four different account types, all with slightly different trading parameters. Here’s a breakdown:

| Account | Profit targets (phase 1/phase 2) | Max drawdown (overall/daily) |

| Standard Challenge | 10%–5% | 12%–6% |

| Rapid Challenge | 8%–5% | 8%–5% |

| Royal Challenge | 8%–5% | 10%–5% |

| Knights Challenge | 10% (only one phase) | 6%–3% |

The Funded Trader uses different drawdown calculations for different accounts. For the overall maximum drawdown limit, the drawdown is simply a calculation based on your account’s initial balance. For a Standard Challenge, for example, if you have a $100K account, in phase 1 your account balance can’t dip below 12% ($12,000) of $100k. Very simple.

Daily drawdowns are a little more complicated. Most of the Funded Trader accounts use both equity and balance to determine your maximum drawdown. At 5 p.m. EST the value of your account is determined based on both your balance and the equity value of any positions you may have open at that time. They then use the larger number to determine your maximum drawdown.

For example, let’s look at a Standard $100K account, which has a 6% daily maximum drawdown. If you have an open position that is $2,000 in the green at 5 p.m. EST, your account is valued at $102,000. Your 6% maximum daily drawdown is still taken from your initial balance, so $6,000. That means that your new threshold is $96,000. If at any time your account equity dips below that mark, you are in violation.

The overall drawdown for the Knight Challenge is a relative drawdown that moves with your account balance until you reach 6% profit or more, then it stays at the original account balance. That can be a real boost for profitable traders. For example, if you run up a 5% profit on your $100K account, your maximum drawdown would be $99,000. If you make a 6% profit, the maximum drawdown is $100,000. Run that up to a 7% profit, and the drawdown stays at $100,000, giving you a little more breathing room.

Beyond avoiding your maximum drawdowns, to pass any of the Funded Trader challenges, you simply have to reach your profit target within the allotted time (35 days for phase 1 and 60 days for phase 2 with most accounts). Depending on which account you open, you may also have to close any positions over weekends and remain flat during big news releases.

What can I trade with the Funded Trader?

The Funded Trader mostly focuses on forex and offers 44 currency pairs, which should be sufficient for retail forex traders. Beyond that you can trade nine different indices plus gold and silver.

What types of accounts does the Funded Trader offer?

The Funded Trader has four different types of account to choose from. The Rapid account, Standard account, and Royal account all have two-step evaluations, while the Knights account offers a one-step evaluation and no minimum trading days. All, of course, can lead to funded trading accounts should you pass the challenge.

What trading platforms does the Funded Trader use?

The Funded Trader currently uses Eightcap MT4 and MT5 for most accounts, although they are looking to expand their options.

Is the Funded Trader regulated?

Like most prop-trading firms, the Funded Trader is not regulated. Since they are not brokers, they are classified as a financial education company and escape oversight from the SEC, CFTC, NFA, or any other financial regulator.

If I violate the trading objectives do I get a second chance?

The Funded Trader issues second chances only if you haven’t hit your profit target in the allotted time frame. If you’ve been profitable, but not enough to hit the target, and haven’t violated any trading rules, you’ll get a free second chance. For anyone else, you’ll have to purchase a new account and start over.

How do I get in contact with the Funded Trader?

The Funded Trader can be contacted via their Discord link, email: support@thefundedtraderprogram.com, toll-free phone: (888) 920-3079, and, if you can find a stamp, via mail: 14001 W HWY 29, Suite 102, Liberty Hill, TX 78642.

My Funded Trader review summarized in exactly forty words

The Funded Trader has captured traders’ hearts with the industry’s best prices, obtainable profit targets, generous drawdowns, big profit splits, and the best trading community. Check out the Funded Trader for a great place to start your forex trading career.

Comments (No)